•

Feb 4

Traditional media channels, once dominant, are now just one of many options vying for consumer attention. Global viewing habits of many demographic groups are undergoing a dramatic shift, and this change has already occurred for younger audiences. With the rise of social mobile platforms, content consumption is more diverse and fragmented than ever before. The popularity of these platforms has left traditional media with only a tiny portion of the total attention economy, while influencer-driven social mobile platforms dominate audience engagement.

Recently, Jeff Sagansky, co-founder of Eagle Equity Partners, speaking at TheWrap’s Grille conference, warned participants that, unlike previous generations, Gen Z spends only 17% of their entertainment time watching TV, creating more risk in the entertainment industry.

This predicament means that traditional media and entertainment companies (M&E) must adopt innovative strategies, integrate social creator platforms into their business models and foster collaborations that amplify reach and resonate with modern audiences. By doing so, traditional media can harness the potential of social platforms to cultivate new revenue streams and sustain their influence in an increasingly digital world.

The shifting dynamics of the attention economy highlight a significant value gap between Silicon Valley tech giants and traditional media companies. One of the starkest indicators of this gap is the disparity in market capitalizations. Companies like Google, Facebook and TikTok have soared to astronomical valuations, often surpassing century-old media conglomerates.

This surge is primarily due to robust user engagement metrics. Social platforms boast millions of daily active users who spend hours scrolling their feeds. Unlike traditional media, which must compete for audience attention through scheduled programming, these platforms offer a continuous stream of personalized content that keeps users hooked.

YouTube

TikTok

Facebook Messenger

The difference in revenue models further illustrates this divergence between traditional media and special platforms. Silicon Valley’s tech platforms primarily leverage advertising models, capitalizing on the vast amounts of user-generated data to deliver targeted ads.

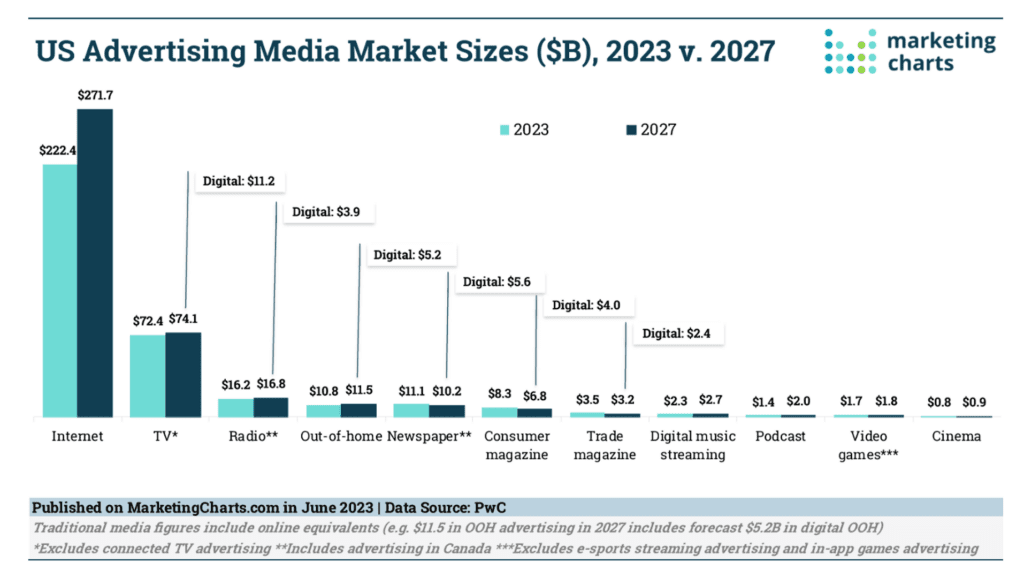

This approach maximizes ad revenue and attracts advertisers seeking highly engaged audiences. While traditional media includes ad revenue, the chart below (US market) shows the overwhelming benefit digital platforms enjoy with engaged vs linear audiences.

Traditional media companies often rely on subscription-based models, which can limit their audience reach and engagement potential. This does not mean that subscriptions are ineffective, but they face challenges adapting to changing consumer preferences for accessible and affordable content.

Traditional media is already well underway in shifting from ad-free subscriptions to various forms of ad support. This trend accelerated when Netflix and Amazon Prime defaulted 200 million viewers to ad-supported services. All other streaming and OTT players have followed suit.

According to the Activate Technology and Media Outlook 2024 Report, cost is the main reason for streaming churn, and ad-supported services have brought down subscription costs. Ad-supported streaming has also had a positive impact on streaming platforms, too. Netflix reported that half of all new subscribers chose ad-supported services, and Amazon expects $1.6 billion in ad revenue this year from its ad-supported streaming service.

Ad revenue has been a core feature of successful digital platforms, underscoring Silicon Valley’s strategic advantages. TikTok revolutionized short-form video content with its algorithm-driven feed, which learns and adapts to user preferences. Similarly, Instagram has continually evolved its platform to integrate features like Stories and Reels, driving users to watch an average of 17 hours of video per week.

These platforms have captured user attention and redefined how value is created and measured in the digital age, challenging traditional media to rethink its business models and engagement strategies.

Media companies must follow these models and develop diverse revenue streams when embracing creator platforms. Successful monetization typically combines multiple approaches: tiered revenue sharing with creators based on engagement metrics, premium content paywalls for exclusive behind-the-scenes material and hybrid advertising models that integrate branded content naturally into creator narratives.

Companies can also leverage creator merchandise partnerships, virtual events and subscription-based fan communities. The key is maintaining authenticity while creating value.

A content curation network is an innovative platform that leverages AI to aggregate, organize and present media content in a personalized and engaging way. In M&E, where content is abundant, these networks help consumers find relevant, high-quality material.

For example, TikTok’s content curation network demonstrates AI’s impact on short-form engagement. Its AI system analyzes viewer behavior at a granular level — measuring watch-time completion rates, re-watch patterns and sharing behaviors for clips under 60 seconds. The system then uses this data to create “content affinity clusters” that help creators and media companies understand which short-form formats resonate with specific audience segments. This AI-driven approach helps media companies efficiently distribute and monetize short-form content across creator networks.

These platforms feature advanced technologies to enhance user experiences and engagement metrics. By analyzing user preferences and behavior, a content curation network can intelligently highlight the most pertinent articles, videos, music, or other digital media tailored to individual tastes. This pinpoint accuracy enhances the user experience and empowers media producers to reach their target audience more effectively.

Owning a platform that serves as a curation network is emerging as a pivotal strategy for M&E companies to capture and sustain value. As owners, companies can monetize content in the ecosystem by controlling the flow of information, managing user engagement and leveraging data insights to optimize content delivery.

A critical aspect of this new strategy is empowering influencers to build scaled curation networks within these platforms. Influencers are modern-day tastemakers who can drive trends and consumer behavior. Enabling them to curate content on a large scale allows M&E companies to leverage the reach and impact of these individuals to attract and retain audiences. These platforms create a symbiotic relationship in which influencers benefit from increased visibility and monetization opportunities, and M&E companies extend the reach of their content.

These platforms must provide influencers with the necessary resources and tools to contract, manage and distribute content efficiently, enhancing their effectiveness as partners in content creation. This strategy involves leveraging technological advancements, like AI and machine learning, to improve user experiences, optimize content discovery, drive engagement and fuel growth and innovation. This approach boosts the platform’s appeal to influencers and enhances its competitive edge.

Finally, owning a curation platform allows M&E companies to participate in technology market capitalization multiples. By positioning themselves at the intersection of technology and content, these platforms can tap into the lucrative valuations associated with tech companies.

Adapting monetization strategies to remain competitive in a world dominated by social media content creation is not just an option for traditional media — it’s necessary. The shift in viewership from television to platforms like YouTube, TikTok and Instagram highlights the growing demand for personalized, on-demand content. Media professionals must prioritize understanding their audience’s consumption patterns and actively explore collaborations with influencers. By bridging the gap between traditional approaches and the interactivity-driven nature of social media, traditional media can retain relevance and uncover new opportunities for growth in the digital age.

Other articles that may interest you